Monday again! That means another look at the markets.

In the last edition of Zeahl’s Edge we looked at the impact on the crypto market following the approval of Bitcoin ETF's as well the S&P’s never-ending flirting sessions with all time highs,.

Bitcoin

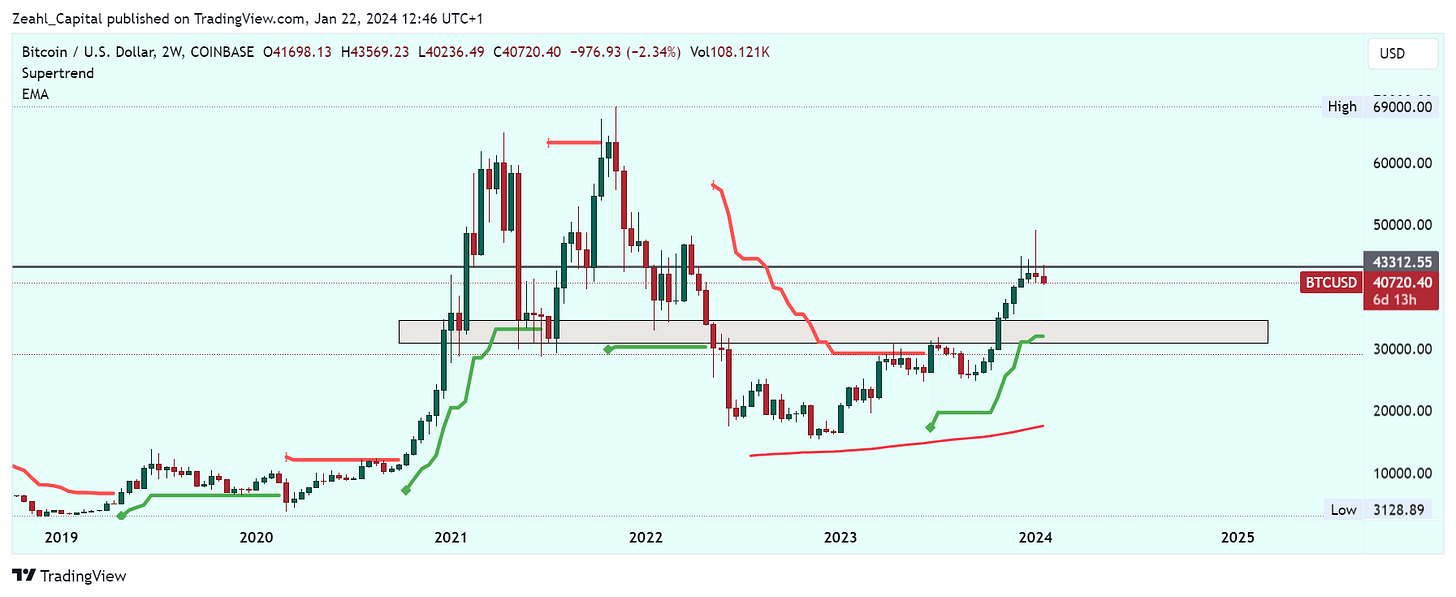

Since the SEC gave the greenlight for Bitcoin ETFs on January 11th, the price of the number 1 cryptocurrency has dropped 17%. Those who follow this page and the Zeahl twitter account would have known that this was a prime ‘sell the news’ event and perhaps saved some money amidst the euphoria.

While Bitcoin topped at around $49,000 on the day of the launch, it currently trades at around $41,000. At Zeahl Capital, we called the top of $44,000 on December 5th, explicitly stating that anything above was simply a deviation. That came to fruition.

Now the question is, where it will bottom? Well in the same tweet that we called the top, we also made a price prediction for the bottom. The big area of interest is mid $30,000s.

$30,000 was the first major resistance of the ETF rally, indicated by it being a major support during the bull run of 2021. This area is ripe for liquidity, with stop losses, early entries and resting bids sitting there. A successful retest of that resistance would flip it to support and mark the start of the next bull phase.

At Zeahl we’re predicting a cycle top of $200,000 per Bitcoin. Watch this space!

Stocks

The stock market is surging. The S&P did indeed closed at new high on Friday. Tech stocks are leading the way and with a third of the index weighted to tech, it’s not hard to see why.

Indices tend to be a safer option to stocks due to the basketing effect however with such a high concentration of tech stocks within the S&P500, it’s almost become a tech stock ETF.

Nevertheless, the rally in 2023 in tech stocks such as NVIDIA, Meta, Apple, Microsoft and Amazon carried the S&P to new highs.

With all eyes seemingly on the US election and Trump’s demolition job at the Iowa caucus, investors may be looking to price in a Trump presidential win. If Trump were to be elected, it’s quite likely we will see a significant market boom.

Nevertheless, there is still the threat of a recession as has been highlight by several banks, including JPM 0.00%↑ JP Morgan. Whether the Fed can avoid a recession for the second year running is yet to be seen. With CPI due to be released on Friday, forecast is 3.0% vs the previous month’s 3.2%, a key indicator will be whether the Fed can begin cutting rates. So far, rates are expected to remain stable. Higher for longer perhaps.

China

Something to take note. The CSI300, an index of mainland Chinese shares, tumbled to 7 year lows sparking fears of significant downturn in the Chinese economy. China's economic rebound in the post-pandemic era has been fraught with challenges, notably stemming from a dual crisis in its property sector, with the collapse of Evergrande notably, and demographic trends. The nation's birthrate has plummeted to unprecedented lows, contributing to a population decline for the second consecutive year as of 2023.

Despite a GDP growth of 5.2% in 2023 compared to the previous year, the Economist Intelligence Unit (EIU) categorize this performance merely as satisfactory. The road ahead for China's economy remains littered with obstacles.

Thanks for reading and good luck with your trading.