2023

So 2023 is over! Markets across the board recovered their 2022 losses and some indexes like CAC 0.00%↑ and DAX 0.00%↑ traded at all time highs during the year. The Dow in the US rallied to all time highs whilst the S&P500 sits less than 1% off it’s high.

We saw crazy tech and AI gains with NVDA 0.00%↑ leading way with a monster 240% move. $APPL put in an all time high whilst META 0.00%↑ is just shy.

In FX the USD momentum waned in Q4 ending the year 2% down having previously been up 4% on the year. The $USDJPY trade having gained 16% on the year but closing at just under half of that after topping at $152 and retracing down to $140. $152 is a four decade long resistance level so no surprise to see that sell off heavily.

Gold put in a new all time high and is currently trading at $2062 per ounce. A 13% increase on the year.

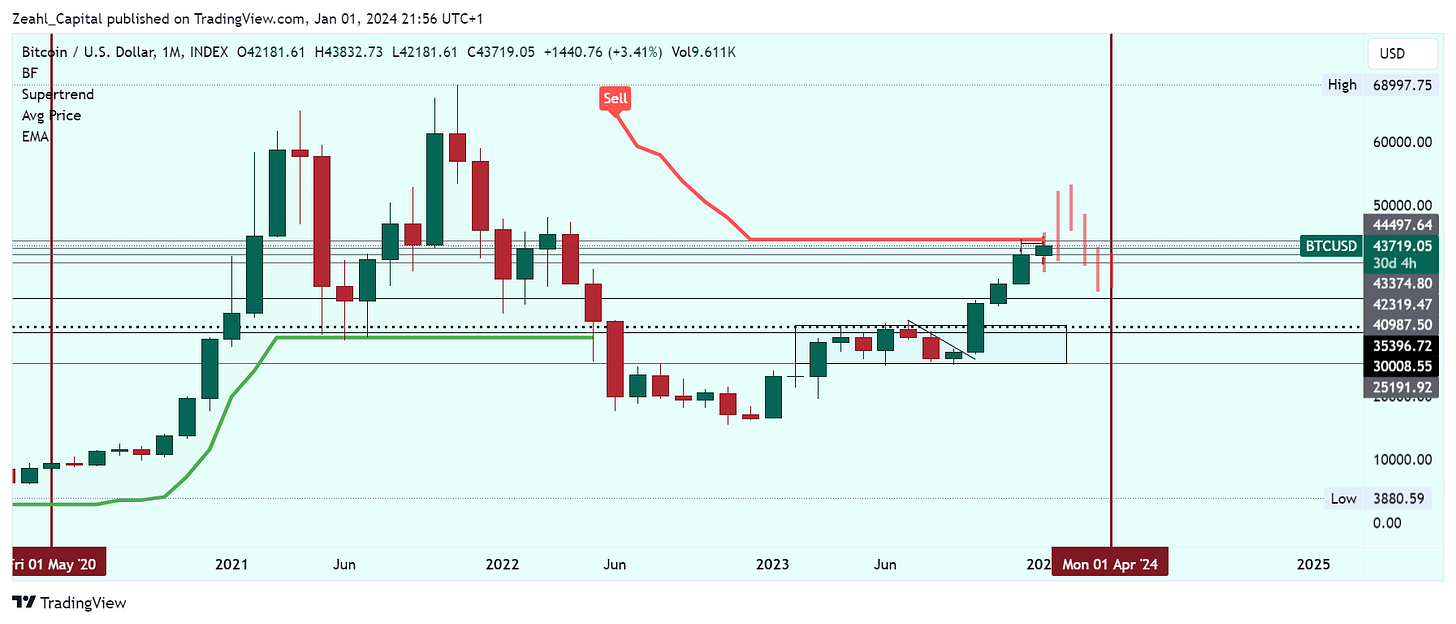

Crypto recovered significantly from it’s 2022 year of disaster which saw multiple scandals wipe hundred of billions of dollars off the industry market cap. Bitcoin ended the year with 150% gains whilst many altcoins pulled multiples of that. With the Bitcoin ETF expected to be approved this week, which would see big players like Blackrock enter the market, the market could see serious inflows in anticipation of that announcement.

2024

There have been mixed signals about 2024. Despite the worst of inflation behind us and rate hikes seemingly ending by major central banks, leading banks like JP Morgan are forecasting a challenging year. Meanwhile, with rates expecting to be paused and perhaps even cut during the year, this loosening of financial constraints could be a stimulus for stocks to continue rallying. With the War in Ukraine slowly but surely appearing to be nearing it’s end, a more stable outlook is on the horizon for Europe.

So what to expect in 2024?

At Zeahl Capital we’re anticipating a tepid, perhaps even cautious Q1. Prices are high but the economy is still hot .Therefor there is no reason to suggest that stocks are overvalued. With the US election towards the end of 2024 we expect the stock market to perform well as it as done so historically. The outcome of the election will likely reflect the market’s performance in 2025.

For Forex, it is expected that the USD will continue to lose value into Q1 and maybe even Q2. An area of interest for the DXY is around $97. We should see a reversal there.

We’re expecting high volatility in Crypto in January. With the ETF announcement on the horizon, we’re expecting the market to bid heavy into the announcement with Bitcoin rising potentially 25% from it’s current price of $43,000. We do believe however that this will be a ‘sell the news’ event with the ETF approval effectively already priced in. Impulse moves are expected to be retraced and possibly correct as far down as $36.5k before enjoying a very strong Q2 and Q3 where all time highs and beyond will be in the sniper scope. Expect that Bitcoin outperforms altcoins initially with an altcoin rally in Q3 or Q4. Either way, at Zeahl we’re expecting a strong year for crypto.

Closing Remarks

Zeahl Capital [@zeahl_capital] is very active on X [formerly Twitter] with multiple setups posted on there daily. This space will be used as more of a newsletter with the expectation to release once weekly. Subscribe [for free] to receive the newsletter directly in your inbox weekly.

Here is a sample of the setups posted:

Stocks

Robinhood HOOD 0.00%↑ up 34% since this tweet.

Shift 4 FOUR 0.00%↑ up 16% since this tweet.

Forex

USDJPY down 6% since this tweet to short.

Crypto

AVAX up 252% since this tweet.

FTM up 42% since this tweet.

RUNE up 74% since this tweet.

SOL up 32% since this tweet [and I got in late].

Perhaps the best call was actually the local top on Bitcoin being at $44k since the beginning of December.

Subscribe below for the weekly newsletter and follow us on Twitter for immediate access to these calls.

In the meantime, we wish you a very strong, peaceful and prosperous New Year.