Price Surge

Oil has been surging since June, gaining over 30% in that time. It’s still around another 30% off the 2021 highs but with winter around the corner and demand for oil not abating, the price could surge further in Q4.

Bad Macro Cocktail

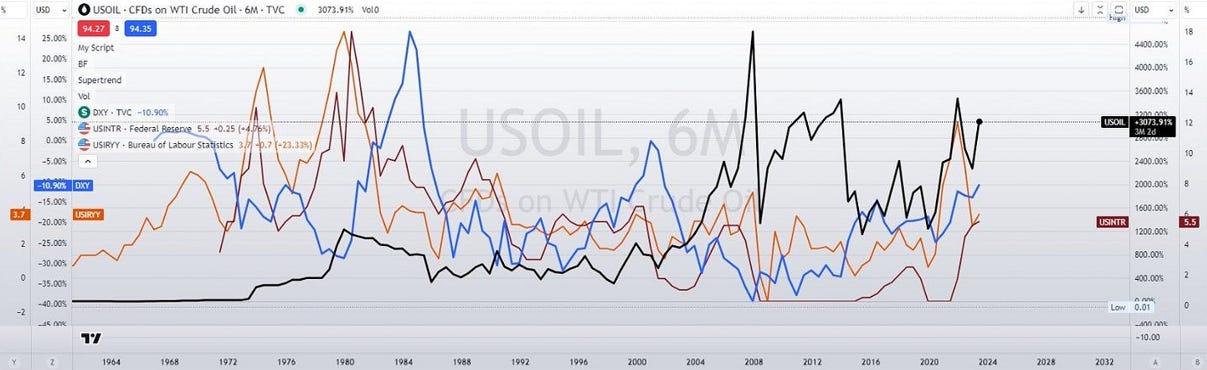

A tweet I posted recently highlighted the major concerns of a continued price surge. With inflation still above the 2% target [which is totally BS btw] and interest rates over 5% we find ourselves in a sour state of affairs. In fact, when you consider these three metrics together an interesting story emerges.

There has never been a time when oil was trading at these prices whilst inflation and interest rates were this high. In fact, never have these three metrics trending so perfectly in sync together.

You could argue that the surge leading up to 2008 had similar conditions. Notably though, the situation we’re in now could end up much worse considering that inflation and interest rates are higher than 2008 whilst the price of oil is still far lower.

A rise in oil prices will add more fuel to inflation and this will require further rate hikes to bring under control.

Up, up and up.

What does this mean? Well, the blue line represents the dollar and as you can see it is trending perfectly in sync with the other metrics. A strengthening dollar will negatively impact the stock market and the overall economy.

Diverging Timeline

We are seeing, in real time, a completely new scenario evolve and with it a stuttering response by central banks. They didn’t hike high enough quickly enough. They are now in a position where they can’t hike and they can’t cut. Whatever move they take will break something.

The irony of all this of course is that oil, the go to lubricant, may end up being the component that seizes the economic engine.