**Linked Thread**

Before I get into this post I’ll just add a couple of links referring back to previous posts I made about the stock market. The threads are a continuation.

Crash, Bang, Wallop!

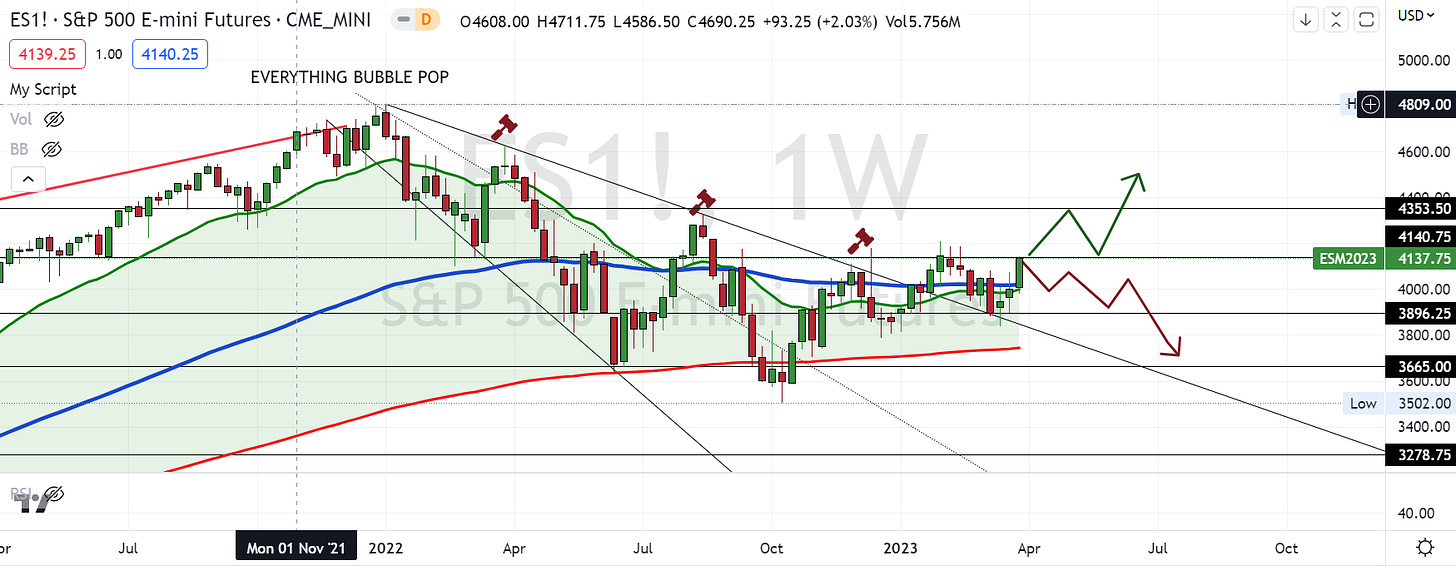

Q1 is done and dusted! The S&P rose a whopping 7% to kick off 2023 in stunning style. The S&P is now approximately 13% off the all time high of 4,800 set back in January of 2022. At the lows, the index had dropped almost 30%. An impressive recovery and yet much of the issues that led to the drop are still present. Inflation for example, is still over 3x of the 2% target. And that’s just in the US.

In the UK inflation sits at 10% yet the FTSE100 hit an all time high in February and retraced slightly this month. The situation is very similar in Germany with the DAX in Germany and the CAC in France. So inflation is still rampant, the central banks are hiking interest rates yet the stock markets are running feverishly hot.

Keep in mind all of this happened in the face of 4 bank blow ups including a G-SIB in Credit Suisse. Yes they were bailed out!

Meanwhile to close the month the BRICS, led by China, began assembling the avengers to take down Captain America, the USD. I would’ve said Thanos but that tag will eventually belong to Bitcoin, up 72% in Q1.

For those paying attention we are entering a new timeline in human history. We are witnessing divergence of our established structures in real time. That’s for another thread though.

Money, Money, Money!

So Q2 is upon us. What does that mean?

Well first of all, earnings season. Companies will be releasing their financial statements for 2022. Obviously, they are releasing just in time with the S&P in a peculiar spot. Having performed so well in the last three weeks of the quarter, the index sits at horizontal resistance.

With that in mind, there is reason to be both bullish and bearish here.

Bullish

The price broke out of the diagonal resistance and successfully reclaimed is as support whilst also doing the same with the horizontal resistance. Impressive!

The Fed is winding down rate hikes. It is believed that only one more hike of 25bips is on the cards before the FED switch their attention to planning cuts in 2024.

Earnings. Good earnings —> price up.

The bearish case, whilst not as strong as last year, still holds.

Bearish

Price is at resistance. Euro markets are at all time highs. That’s a sign that perhaps the market is overheated and traders may take the opportunity to book profits at these levels. If the S&P cannot flip resistance, expect a decent sized retrace.

Money markets. A buzzword in March. Depositors are fleeing banks in droves and parking their money in higher interest money markets. These money market funds generally invest in debt securities such as T-Bills and government bonds. That means liquidity is moving away from risk on areas to risk off.

Earnings. Bad Earnings —> price down.

Musical Chairs

And so as we move into Q2 it’s hard to imagine that there can be as much bearish news as we’ve seen in Q1. Then again, since 2020 it’s been an endless stream of pretty bad news. Remember when the US and Iran almost kicked off WWIII in 2020. Yeah me neither.

It’s clear however that the market is irrational. The idea of an efficient market makes sense when the underlying engine is running smoothly. The more out of sync parts get, the less rational the market becomes. And so we are in a period of high volatility, even if the $VIX is a meme at this point. I expect a noisy and explosive Q2. Whether the stock market continues it’s hot streak or corrects is a coin flip though.

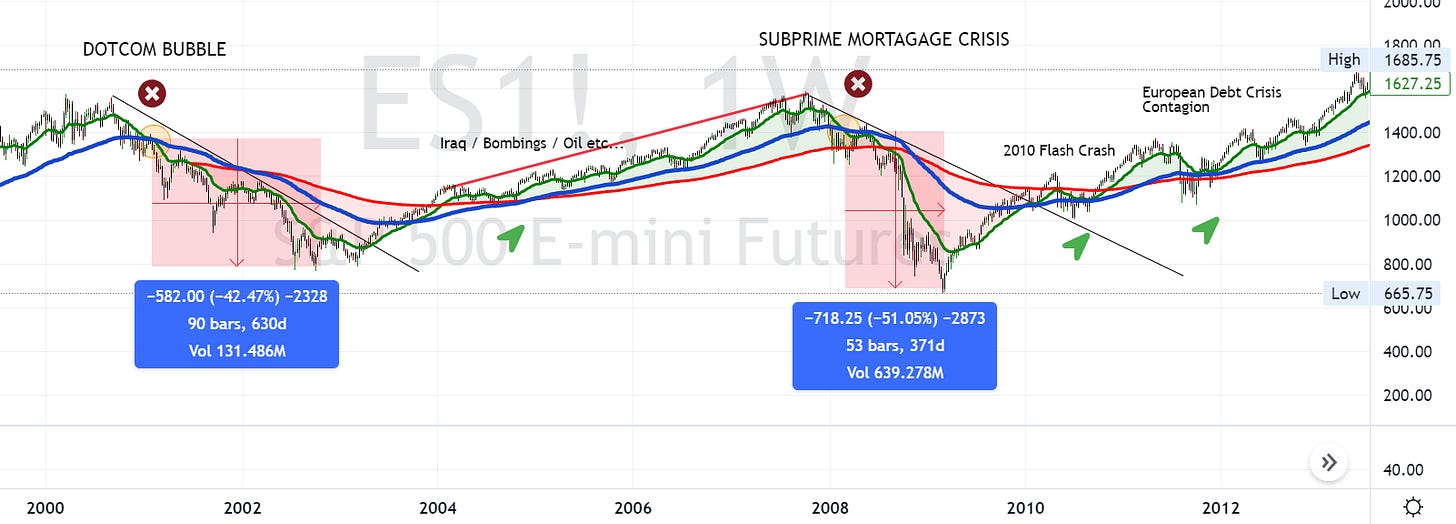

I started this thread by linking to my first post. The bearish case I presented had linked fundamentals to the technicals. The technicals in this case were the 21 & 89 EMAs crossing. The 21 dropped below the 89 in September of last year and hasn’t reclaimed it since. I noted that this happened on two occasions in the recent past, the Dotcom Bubble [2001] and the GFC [2008]. Upon crossing downwards, the index dropped a further 40%-50%. It’s important to note that the EMAs did tighten before the drop. Similar to now.

In this fascinating game we call the financial markets we love the volatility. The sound of the music as us bulls and bears dance around the chairs brings an intense adrenaline to our systems. When the music stops however, only one side will be sitting happily.

Listening closely. The market is making noises, loud noises. The question is, are they coming from a spluttering engine on the brink, or a generator punching life back into the old machine?