#13. ZC: The Death of the Bear.

A dive into bearishness and why bears are almost always wrong.

Being bearish sucks. My intro as my conclusion.

I have seen hundreds of bearish posts on social media for the past two years, all of which continue to be bearish despite the markets clearly telling them they are wrong.

I can tell you, there is nothing beneficial about being bearish except for that brief ‘ego trip’ one takes when the market ‘crashes’ to levels not seen in a month, only for it to quickly fade away as the market does what it always does. Grow.

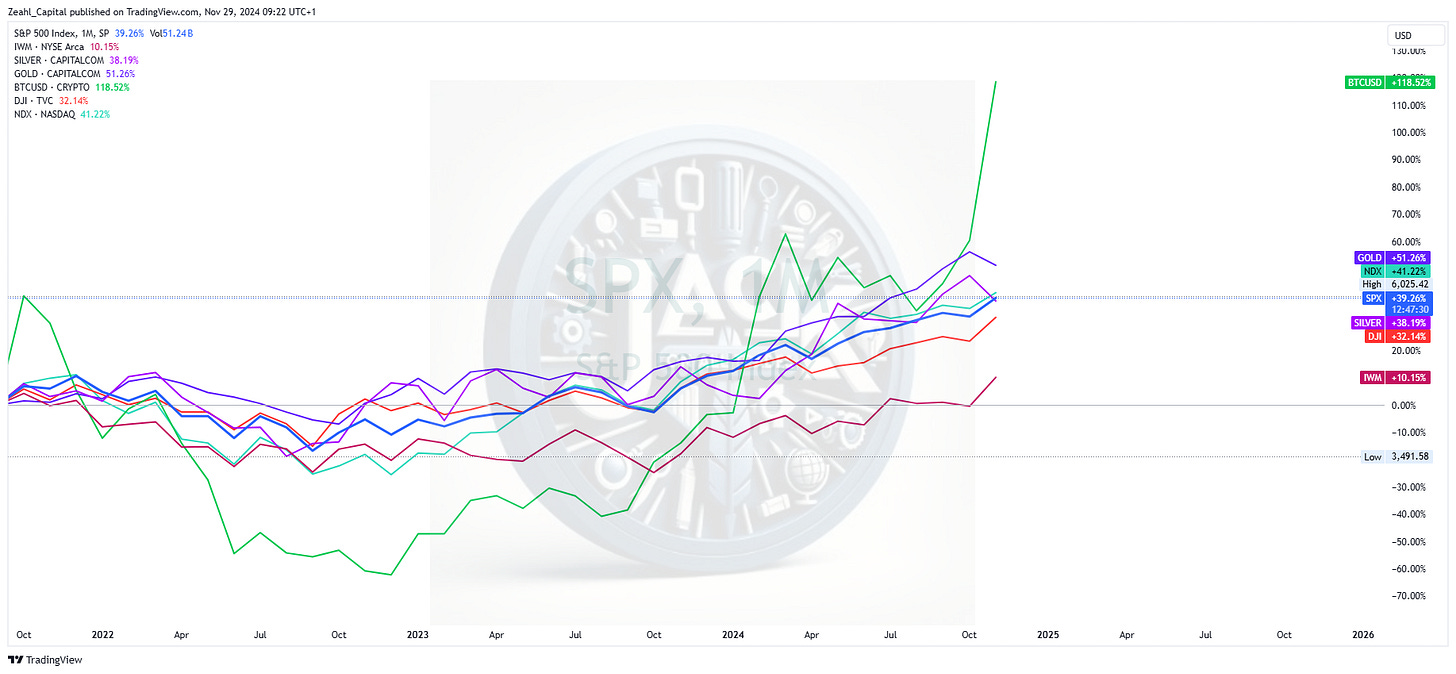

A skim through some posts under my Zeahl Capital page will highlight that I have been guilty of being bearish on occasions (however I do much prefer being a bull). For over a year, markets have weathered a storm of bearish predictions. Inflation fears, geopolitical turmoil, rising interest rates, and whispers of economic slowdown dominated headlines, with countless ‘prophets’ warning of an imminent collapse. And yet, 2024 proved them wrong, again. Global equity markets surged, with the S&P 500, NASDAQ, European indices, Gold, Silver and Bitcoin all hitting record highs.

Those who stayed on the sidelines or worse, shorted the rally, have been hammered. The market has delivered a crystal clear message: relentless pessimism doesn’t just miss the mark; it almost guarantees failure. The opportunity cost alone is staggering, and the odds of winning by shorting progress are practically zero.

The Relentless March of Progress

History shows us that markets, by their very nature, move upward over time. Since the early 1900s, the S&P 500’s average annualized return is around 10%, weathering wars, recessions, and market crashes including the infamous Great Depression. Investors who stay invested tap into the extraordinary power of compounding. Bears on the other hand face an uphill battle against odds firmly stacked in favor of long-term growth.

This year, despite relentless warnings of a recession, the S&P 500 rose roughly 25%, with the NASDAQ and DOW putting up similar numbers. For those who shorted these indices or held cash, the opportunity costs were crippling. Bears only win occasionally. Bulls always win.

Take the greatest meltdown of my lifetime (I was 10 during the DotCom), the Global Financial Crisis of 2008. The meltdown wiped out 56% of the S&P 500’s value at its worst. Fast forward a few years later to March 2013 and the index had fully recovered. By the end of the 2010s, it had tripled. The bears who stayed out missed a decade of transformative growth. Those who held their shorts, well, how do you recover from that?

The Old Adage

Bearishness thrives on the illusion of market timing. The idea is seductive: avoid the downturn and sidestep the pain. But even the very best of the best in the finance world struggle to time markets accurately. Data from Charles Schwab reveals that missing just the 10 best days in the market from 2002 to 2021 would slash annualized returns from 9.5% to 5.3%.

For bears, the challenge is even steeper. To profit, it’s not simply predicting when a downturn will occur but they also have to navigate its magnitude. They face mounting costs in interest, fees, and margin calls. All while waiting for validation which comes with a very steep price, health. Very few can stomach the financial and psychological toll of holding a short position during a raging bull. Even Michael Burry, whose famous 2008 housing short paid off, endured years of mounting losses and pressure before his thesis bore fruit. Was he right? Certainly. But how often are his bearish theses right? Well, what happened the last time he called for a crash? That was in January of 2023 when the S&P500 was $3,800. It;s 6,000 now (+57%).

Bears Lack Stamina; Bulls Run Long

History proves that bear markets are short-lived. The Great Depression bottomed after 5 years. The following crashes bottomed within 2-3 years. Bull markets meanwhile run on average 6-8 years and return significantly higher gains then you could get shorting a bear. Nowadays bear markets are even shallower. The COVID-19 bear market in 2020 lasted a mere 33 days before giving way to one of the fastest recoveries ever. Now, we know why. We know it’s kind of “rigged” but that doesn’t change how one invests.

Investors who stayed bearish missed out on a crazy rally, with the S&P 500 and NASDAQ doubling in value within 18 months. Betting against recovery and growth is a losing game.

By the way, the break out of that chart is scary on so many levels. That’s a post for another day.

Betting Against Human Ingenuity

But there’s something deeper psychologically when it comes to bearishness. At its core, it is a bet against humanity’s ability to innovate, adapt, and grow. While macro risks like inflation, geopolitical strife, and wars are real, markets reflect the resilience of human enterprise.

Look no further than the tech rally we’ve had. Critics called valuations in companies like NVIDIA, Apple, and Microsoft unsustainable. Yet NVIDIA still became the first semiconductor company to hit a trillion-dollar valuation, fueled by the AI craze. Those who bet against it paid dearly.

There is a famous saying, “You can choose to be right or you can choose to make money”. You will always find bearish indicators in the macro that validate your bearishness but often it is there to fool you. I’ll be the first to put my hand up and say that I allowed the macro to fool me in a big way.

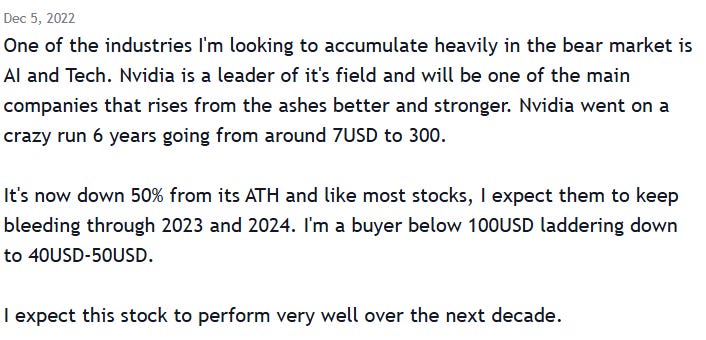

Below is a post I made on Tradingview in December of 2022. The price of NVDA was around $140 which post stock-split puts it $14. The macro fooled me into believing the bear market wasn’t over. So I kept waiting for lower prices to buy it. Even though as you can see, I was sure that it would be a king runner, I didn’t buy it, fearing a steeper correction. Fast forward to now and a $10,000 investment would be worth close to $100,000 just two years later. I let the macro cloud my judgement. This is what bears go through.

Because you see it wasn’t enough that I thought that prices would be higher within a decade i.e. I would make a lot of profit even if I bought at what I thought wasn’t the bottom price. I wanted to buy it cheaper. This is a key mistake bears make. When markets correct, bears always want lower. And so, it becomes a question of time and as we’ve seen, bear markets are short. Greed makes bears wait. That wait costs them. It cost me.

Tesla offers another example: heavily shorted for years, its stock surged over 12,000% from 2010 to 2020, punishing skeptics who doubted Elon and his vision.

The Seduction of Pessimism

So why do people get bearish. Well there are genuine reasons to do so. Take 2022 when Russia invaded Ukraine and inflation was rampant. There was a genuine threat to stability. However a major reason people get bearish is that there is a psychological allure to bearishness. It feels sophisticated to predict doom while others are optimistic. It goes against the grain. Everyone cannot be right, so my contrarian approach must be right. It projects an image of intellectual rigor, of seeing risks others ignore. It feeds the ego into believing that the bulls are the sheep and the bear is the wolf, waiting to feed. But this mindset blinds investors to the broader truth: progress is the norm, not the exception.

History rewards those who bet on innovation, growth, and resilience. Bears may sound wise in the short term, but their long-term track record is quite frankly abysmal.

Flipping bullish to bearish and vice versa is good. Having an open mind is good. Constantly looking for validation to be bearish in a bull market is an ego trip. You are more worried about being right than making money. The name of this game we call financial markets is about being profitable.

Conclusion

Now here’s the thing, it’s hard to bullish with prices looking like this. I mean you have to ask yourself, is this sustainable? The reality is it might be.

Without being bearish, you can be cautious. Cautiousness has its place in investing. Diversification, risk management, and an understanding of macroeconomic trends are essential. But caution isn’t pessimism, and bearishness isn’t prudence. Caution is ensuring that your positions are protected from an unknown or unforeseen event. But again, that is an exception, not the norm. You protect against the worst, not bet on it.

Investing is an act of belief. Belief in human potential, in the power of markets to adapt and grow. Betting against that belief is a losing proposition. While bears may enjoy fleeting moments of vindication, the long game belongs to those who embrace progress.

The verdict is in: Being bearish sucks.

P.S. apologies to my fellow bulls because this post will 100% mark the market top!